Unknown Facts About Finance

Wiki Article

3 Easy Facts About Finance Shown

Table of ContentsThe Basic Principles Of Finance Finance Things To Know Before You Get ThisSome Ideas on Finance You Should KnowFinance for Beginners

We have actually spoken before concerning the close link between monetary and mental wellbeing. A study by the Money and also Mental Health Plan institute discovered that almost 46% of individuals with debt problems additionally have a mental illness as well as that even more than 80% of people who experienced psychological health troubles said that their financial scenario had made these concerns worse.The more you gain, the bigger the debts you can collect - finance." For these reasons as well as more we chose MIND as our Blue, SKY charity of 2020. For even more than 60 years, MIND has actually worked to supply recommendations as well as assistance to encourage anybody experiencing a psychological wellness issue. They have actually touched numerous lives and their prominent projects have actually promoted a far better understanding of psychological health.

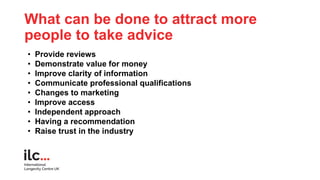

The 3 primary reasons why financial advice can sustain psychological wellbeing Customers that receive monetary suggestions trust fund their advisor and also are satisfied with the service they obtain. Complete satisfaction also increases with time where there is a continuous relationship in place. Individuals who get economic suggestions really feel more certain concerning their future as well as really feel even more economically resilient.

Get This Report about Finance

" They [believe] it's more crucial to obtain the company up and also running and pay every person else. However, if business doesn't exercise, you will not have ever paid on your own. Remember, you're part of business as well as you require to compensate yourself as long as you pay others. visit this website 2. Invest in development.

This can permit your company to flourish and move in a healthy and balanced financial instructions. Edgar Collado, primary monetary police officer of Tobias Financial Advisors, claimed i loved this local business owner must constantly keep an eye on the future." A little service that intends to remain to expand, innovate and also draw in the best workers [needs to] demonstrate that they agree to purchase the future," he said.

Change the settlement terms to '2/10 Internet 30.' This indicates if the client pays the invoice within 10 days, they obtain a 2% price cut off the overall expense. Otherwise, the terms are complete payment due in thirty day." 6. Spread out tax settlements. If you have trouble saving for your quarterly approximated tax repayments, make it a regular monthly payment rather, claimed Michele Etzel, owner of Bayside Bookkeeping Services.

The Basic Principles Of Finance

Emphasis on expenses but likewise ROI.Measuring expenses and also return on investment can offer you a clear picture of what financial investments make sense and also which may not be worth proceeding., stated little service proprietors need to be skeptical of where they invest their money.Sorts of service funds, It is necessary to remember that organization finances aren't simply concerning your earnings they're regarding just how you spend your money and also where you get it. When it comes to where you get your funding, you need to comprehend the two primary financing categories: Financial debt funding, Financial obligation funding is a financing that your firm settles with included interest.

You can learn more concerning the distinction between debt and also equity funding right over at this website here. Extra reporting by Max Freedman as well as Nicole Fallon. Some resource meetings were conducted for a previous version of this write-up.

Regardless of where financiers receive their economic recommendations, however, they often tend to invest in comparable methods. Almost 3 in four monetary advisors (71.

Indicators on Finance You Should Know

Because inadequate portfolio diversification is the second-most usual investment mistake among potential as well as brand-new customers, we asked financial consultants the property classes capitalists are overinvested as well as underinvested in. Beyond supplies and equities, consultants say that possible as well as new customers are frequently overinvested in money as well as underinvested in bonds. Retired life planning is, without a doubt, the most typical factor capitalists look for a monetary advisor.The second-most typical factor, according to economic consultants, is improving investment returns, which virtually 30% of financial consultants detailed as either the top or second-highest top priority for prospective customers. Concerning 55% of financial advisors say that prospective and new customers have impractical return assumptions. In reality, when considering their very own solutions, economic experts report that their worth suggestion is greater than simply improving their clients' investment returns.

Lots of consultants additionally claim that it is among one of the most underutilized customer service, as previously noted. Retired life preparation and also heritage preparation are the 2nd- and third-most underutilized financial advisor services according to our study. Approximately 24% of consultants state that retirement preparation is the most underutilized service and also regarding 17% responded that legacy planning is one of the most underutilized.

Report this wiki page